Investments

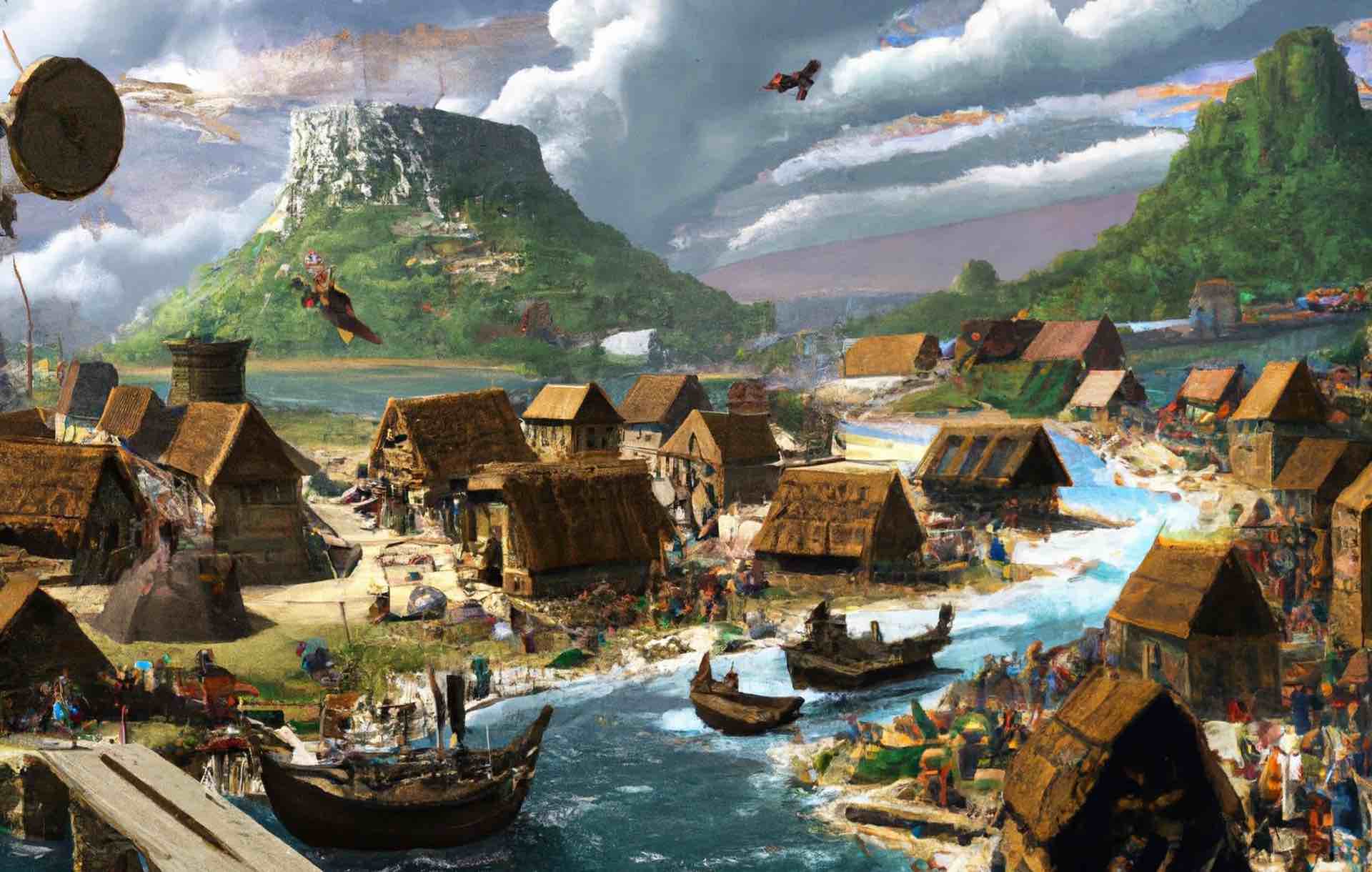

In a world where traditional investment options can sometimes feel stagnant, an exciting frontier beckons to the adventurous investor: alternative investments. These unconventional avenues have captured the imagination of many, offering unique opportunities to diversify portfolios and potentially reap substantial rewards. In this article, we delve into the captivating realm of alternative investments, exploring their allure, challenges, and the broader economic implications of this financial adventure.

Alternative investments encompass a wide array of assets beyond the familiar realms of stocks and bonds. These include real estate, private equity, hedge funds, venture capital, cryptocurrencies, art, and even collectibles like rare stamps and vintage wines. What makes alternative investments alluring is their potential to generate high returns, sometimes uncorrelated with traditional markets. Investors are drawn to the promise of diversification and a chance to ride the waves of unconventional opportunities.

The beauty of alternative investments lies in their diversity. Let’s embark on a journey through some of the most enticing options:

Owning physical properties or investing in real estate funds has long been a favorite among alternative investors and it’s one of the oldest investment types.

It offers the potential for rental income and property appreciation, often immune to the short-term fluctuations of financial markets.

Real estate has historically appreciated in value over time, providing investors with the potential for significant capital gains. Furthermore, Real estate investors can use leverage to magnify their returns.

Investing in private companies before they go public can be highly lucrative. Venture capital fuels innovation, while private equity often seeks to unlock the potential of established businesses.

Private equity is a type of investment that is typically used to acquire and improve existing businesses. Private equity firms typically look for companies that are undervalued or underperforming, and they use their expertise and resources to improve the company’s operations and profitability.

Venture capital is a type of investment that is typically used to fund early-stage companies with high growth potential. Venture capitalists typically look for companies that are developing innovative products or services that have the potential to disrupt existing markets.

Traditionally, limited to very selected groups of investors, the democratization of finance has led that this world is opening to more and more people. For example, blockchain has helped achieve this via DAOs.

It is important to note that both private equity and venture capital are risky investments. There is a high potential for losing money when investing in these types of companies. However, there is also the potential for generating high returns.

These are actively managed funds that employ various strategies to outperform the market. Hedge funds can be controversial due to their fee structures and opacity, but they remain a significant player in alternative investments.

Hedge funds are private investment funds that use a variety of strategies to generate returns for their investors. These strategies can include long-short equity, market neutral, and event-driven investing.

Hedge funds are also synonymous of high fees. Despite the high fees and opacity, hedge funds remain a popular investment choice for wealthy individuals and institutions. This is because hedge funds have the potential to generate high returns, even in volatile markets. For example, with a short-selling strategy in bear markets.

The rise of Bitcoin, Ethereum and other cryptocurrencies has been meteoric. They offer a decentralized, digital alternative to traditional currencies and have become a favorite of tech-savvy investors.

The future of cryptocurrencies is uncertain, but they have the potential to revolutionize the way we think about money. It is important to do your research and understand the risks involved before investing in cryptocurrencies.

The rise of Bitcoin and other cryptocurrencies has been driven by a number of factors, including:

The art world has been a hotbed of alternative investment activity, with masterpieces selling for astronomical sums at auctions. Rare stamps, vintage cars, and even fine wines also attract collectors looking for unique investments.

This asset class probably is also something that may be linked to your hobbies. Furthermore, the more you enjoy and experience you gain, the higher the returns could be.

Investing in art, watches, comic books or sports memorabilia can be a risky proposition. However, these assets can offer the potential for high returns, and they can also be a way to diversify your investment portfolio.

While the allure of alternative investments is undeniable, navigating this uncharted territory is not without its challenges:

The growth of alternative investments isn’t just a financial curiosity; it carries significant economic implications. As more capital flows into unconventional assets, traditional financial markets may experience reduced influence. This shift has the potential to reshape the global investment landscape, impacting everything from pension funds to retirement planning.

The world of alternative investments is a captivating one, offering the allure of diversification and the promise of unique returns. However, it’s essential for investors to tread carefully, as these avenues come with their share of challenges and complexities. As this financial frontier continues to evolve, it will undoubtedly shape the future of investment, ultimately determining who reaps the rewards of the path less traveled.

If you are interested in learning more about this topic, these are some resources that come handy:

The Fundamentals of Alternative Investments® certificate program: This program will give you a good foundation in the basics of alternative investments and will help you decide if this is an area of investing that you want to pursue further.

The CAIA Level I exam: This is a 6-hour, multiple-choice exam that tests your knowledge of alternative investments.

The CAIA Level II exam: This is a 6-hour, essay exam that tests your in-depth knowledge of alternative investments.

The CFA Institute’s Alternative Investments Primer: This primer provides a comprehensive overview of alternative investments, including their different types, risks, and returns.

The Investopedia Guide to Alternative Investments: This guide provides a more in-depth look at alternative investments, with articles on specific asset classes such as real estate, hedge funds, and private equity.

The Alternative Investment Management Association’s website: The AIMA is a professional association for alternative investment managers. Their website has a wealth of resources for investors, including articles, white papers, and case studies.

Enter your email address to receive the latest articles